Back to All Thoughts

Back to All Thoughts

Inflation: Effect of Inflation on Interest Rates

“We are looking for a house, but the interest rates are around 7%, while our friends who settled a couple of years earlier have 3% mortgages on their houses,” I remember having this conversation a few days ago when I attempted to connect with my uncle, who had just moved to Frisco. Despite a household income above $250k, the latest hikes in interest rates are currently wreaking havoc on households, and the culprit of these hikes is none other than our good friend: inflation.

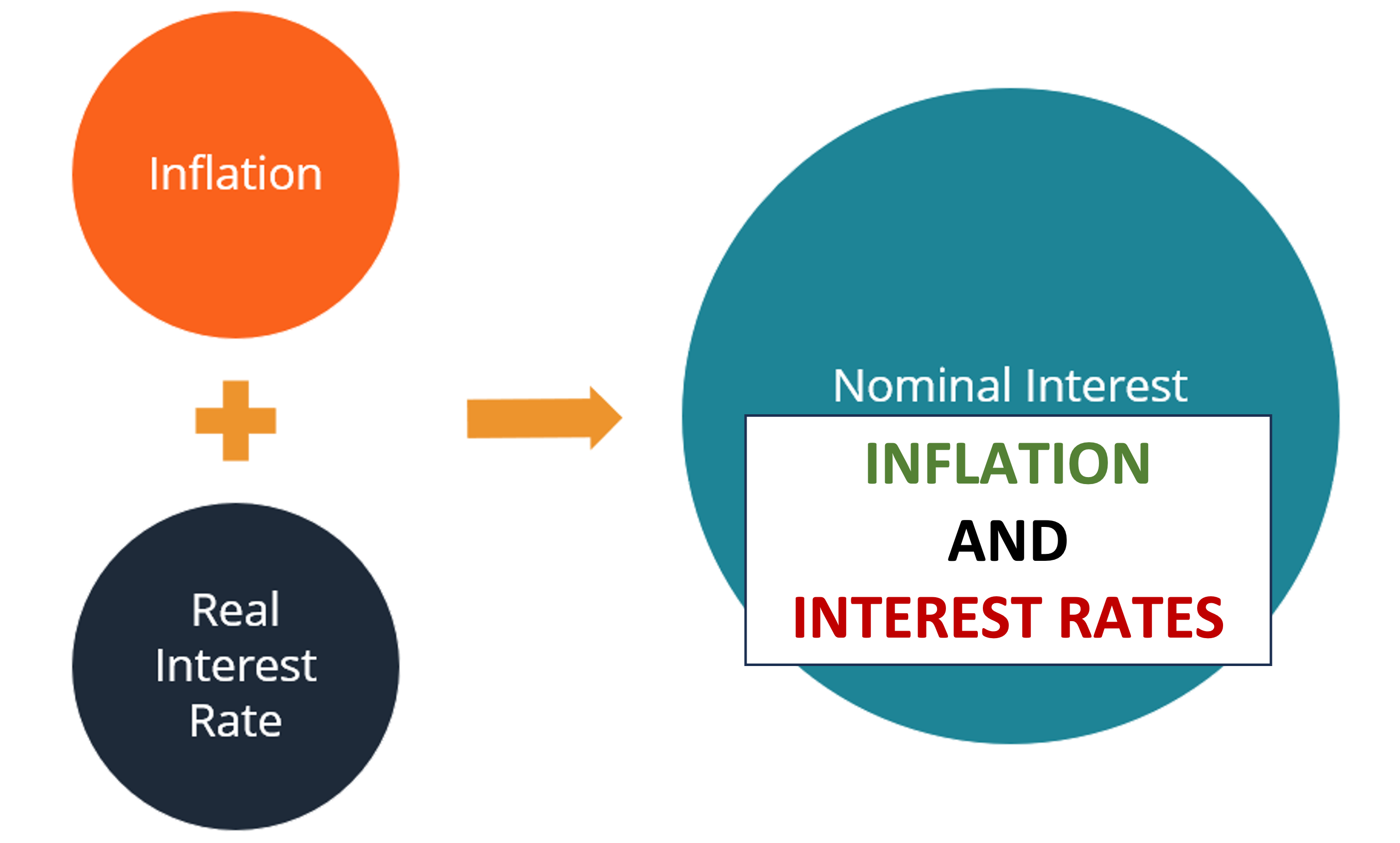

Relationship between Inflation and Interest Rates

With the recent geopolitical conflict and unprecedented amount of federal spending, it’s no surprise that inflation has risen. To counter this rise in inflation, the “Fed” or the Federal Reserve System, which serves as the central banking system in the United States, has been slowly raising the federal funds rate, which is the interest rate at which established banks can borrow from the government. Interest rates attack inflation because they discourage spending as the cost of debt increases; thus, people are less likely to borrow money. As people slow down the borrowing of money, they stop spending it as quickly, resulting in a drop in demand for products, reducing the rate at which prices increase.

Historical Examples

One of the most significant examples of the use of interest rates by central banks to control inflation occurred under Paul Volcker’s tenure as Federal Reserve chairman. During the 1970s, as a result of the Cold War, inflation was consistently flying high, giving it the name “The Great Inflation”; thus, Volcker aggressively tightened monetary policy throughout this period to successfully bring inflation down from over 11% to under 5% with the federal funds rate peaking at 20% during the month of June in 1981. Yet, the consequence of such harsh monetary policy caused a severe recession during this period.

Conclusion

When people discuss the harmful effects of inflation, they normally only talk about its direct effects, namely through rising prices; however, as we’ve explored throughout this Founder’s Thought, inflation can have incredibly harmful indirect effects as well since it can reduce the financial freedom of citizens through high interest rates.