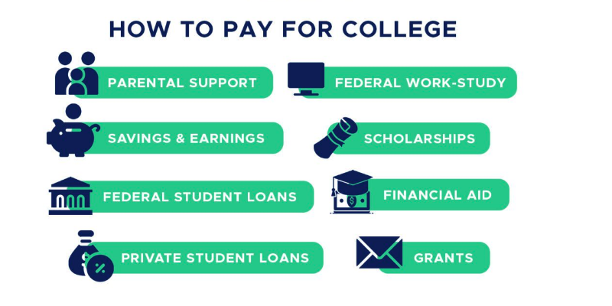

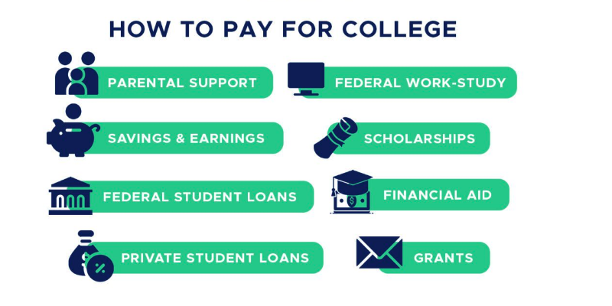

College: Financial Options for sponsoring your college education

For most people intending to attend college, their largest issue is financially sponsoring their education. College Education is expensive, to say the least, but with knowledge about various financial aid options, you can take control and feel more confident, as we discussed in one of our previous Founders’ Thoughts, titled “Investing Strategies for Teens and Young Adults: College.” However, most individuals have started thinking about how they would pay for college too late, yet don’t worry. You still have many options to reduce your and your family’s financial obligations and graduate debt-free!

Scholarships and Grants

Surprise, surprise! You didn’t expect to see scholarships and grants in an article about affording college, did you? Obviously, I am being sarcastic, but where are all these “vast numbers” of scholarships and grants? First, I would recommend looking at your eligibility for various grants, essentially gifts of money. Grants are need-based and are offered by many universities, depending on your FAFSA form, which reflects your ability to pay for college. Universities and governments will fund most grants, so it is essential to look at available grants for which you are eligible. Private organizations, foundations, corporations, colleges, and sometimes government entities often fund scholarships. Scholarships are incredibly diverse as they can be need-based, merit-based, athletic-based, or service-based. Scholarships can also be particular and focus on people who look to study something specific, have a specific interest, or even invested in their community. Either way, grants and scholarships are an excellent way to pay for college and can be applied from the comfort of your house.

Students Loans

Another way to pay for college is through student loans, which are loans provided to students to cover college costs upfront with the expectation that the student will be able to repay the debt after graduation. There are two main types of student loans: federal and private. Most experts recommend exhausting federal student loan options before private student loans because of the disparity in forgiveness and interest. Although student loans are an extremely convenient way to pay for college in the short term, their long-term implications can often be disastrous; thus, it is often a fall-back option.

Part-Time Jobs

Despite the various opportunities that can help families afford college, the ballooning price of college leaves many to take additional action. Here, part-time jobs emerge. Although it can be stressful to have a job while studying, for many, it is necessary and can also provide vital experience and connections for a student. To obtain a job, the first thing to do is look on-campus; here, you can find jobs like teaching assistantships and research assistantships, allowing you to earn money while experiencing academic enrichment. You can also find other jobs, such as a cashier at the school’s bookstore. If all else fails, pursue a part-time job as you would as a high school student.

Conclusion

As the cost of college educations start to financially burden families, it is important to look ways to afford college. By exploring grants, scholarships, student loans, and part-time jobs, you can significantly reduce this financial burden.